2021 electric car tax credit irs

In addition to federal tax credits many states also offer rebates when you purchase or lease an electric vehicle. The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021.

Top 15 Faqs On The Income Tax Credit For Plug In Vehicles

Use a separate column for each vehicle.

.jpg)

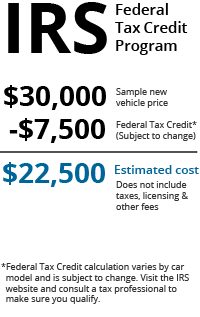

. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question. Electric Vehicle Tax Credit 2021. So based on the date of your purchase TurboTax is correct stating that the credit is not.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. Dozens of electric cars and trucks still qualify for a federal tax credit of up to 7500 for buyers purchasing new. We will update this page once this measure has been made legal.

Filemytaxes November 1 2021 Tax Credits. February 11 2022 529 AM. This means that it can take your tax liability down to 0 but not less than 0.

However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022. Once that happens the unused portion is lost. Posted on August 9 2021.

You would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Report Inappropriate Content.

Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Once that number hits 0 there is no further benefits from any additional non-refundable credits.

State andor local incentives may also apply. Electric cars are entitled to a tax credit if they qualify. As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit.

The exceptions are Tesla and General Motors whose tax credits have been phased out. A Vehicle 1 b Vehicle 2. All the credit can do is zero out your federal income tax on the return.

The credit amount will vary based on the capacity of the battery used to power the vehicle. If your tax bill is reduced to zero then any payments you made may be refunded. The amount of the credit will vary depending on the capacity of the battery used to power the car.

If your tax bill was 4000 then the credit brings that down to. The qualified electric vehicle credit was available for certain vehicles placed in service before 2007. State and municipal tax breaks may also be available.

About Publication 463 Travel Entertainment Gift and Car Expenses. This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582-CR or Form 8810 for the current year. The electric car tax credit is only available to individuals with a gross income of 250000 or less decrease from before.

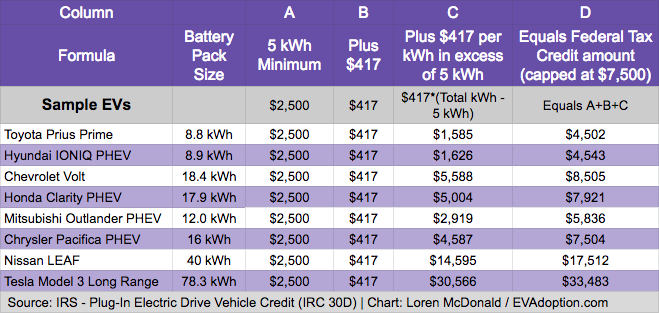

For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an. 421 rows Federal Tax Credit Up To 7500. Form 8936 is an IRS form for claiming the Qualified Plug-in Electric Drive Motor Vehicle Credit on an individuals tax return.

1 Best answer. Notice 2009-89 New Qualified Plug-in Electric Drive Motor Vehicle Credit. Notice 201367 Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. The federal tax credit for electric cars has been around for more than a decade. Additionally this would set an income limit for buyers to 100000.

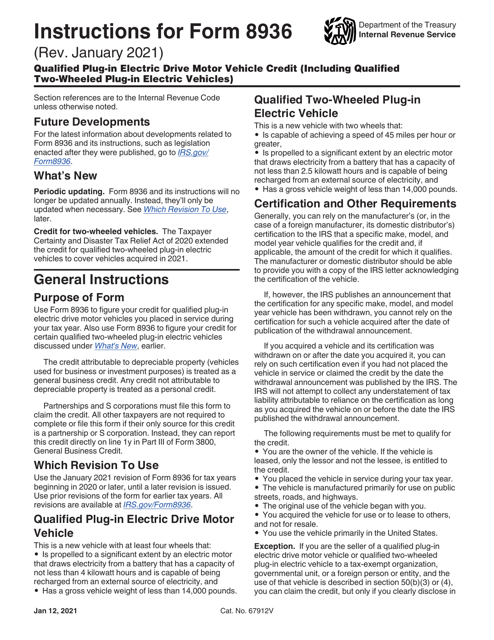

The amount you receive may also be based on income eligibility. Part I Tentative Credit. You must fill out IRS Form 8936 when filing your annual income tax returns.

Use this form to claim the credit for certain plug-in electric vehicles. The amount varies depending on the state you live in but you can expect to receive anywhere from 500 to 5000 back with your purchase or lease. The tax credit is also.

Keep in mind that not all online or software-based. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. If you purchased a Nissan Leaf and your tax bill was 5000 that.

For vehicles acquired after December 31 2009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with. The IRS calculates the credit based on the size of a vehicles battery pack. The Electric Vehicle Credit is a non refundable credit.

Size and battery capacity are the primary influencing factors. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. If you look at your 1040 line 16 you will likely see that the number is 0.

Plug-In Electric Drive Vehicle Credit IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. March 14 2022 528 AM. Table of Contents show.

If you need more columns use additional Forms 8936 and include the totals on lines 12 and 19. Claim the credit for certain alternative motor vehicles on Form 8910.

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Download Instructions For Irs Form 8936 Qualified Plug In Electric Drive Motor Vehicle Credit Including Qualified Two Wheeled Plug In Electric Vehicles Pdf Templateroller

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Latest On Tesla Ev Tax Credit March 2022

How To Calculate The Federal Tax Credit For Electric Cars Greencars

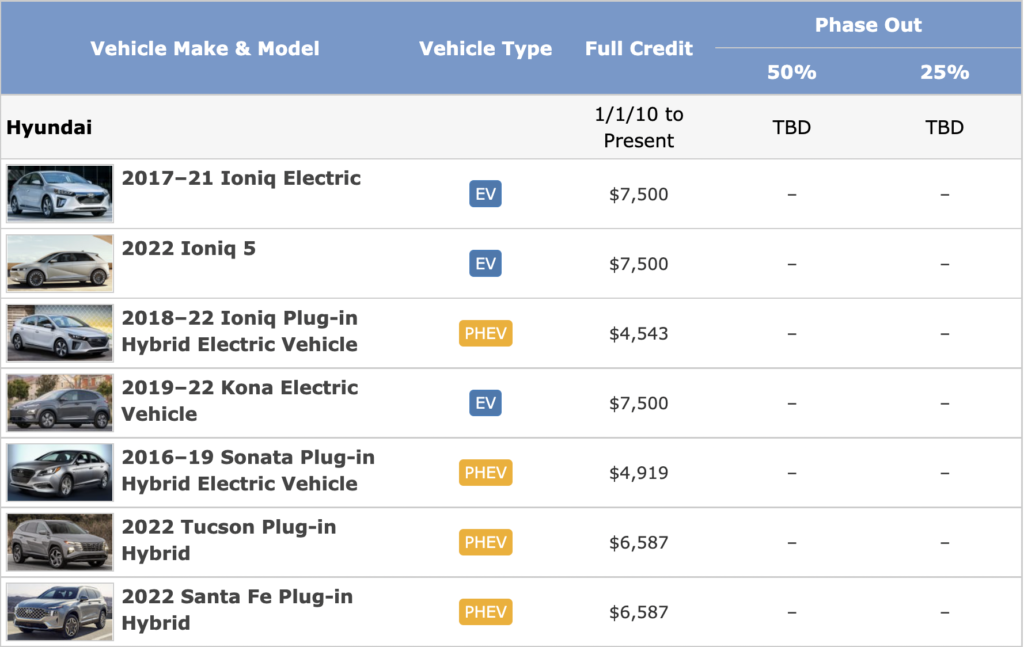

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

Commercial Ev Fleet Calculator And Transportation Electrification Tools

Bmw Ev Tax Credit What Bmw Cars Qualify For Ev Federal Tax Credit

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Why Only 3 Auto Manufacturer S Ev Sales Data Is Being Reported Publicly By The Irs Evadoption

Federal Ev Tax Credit Phase Out Tracker By Automaker Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

Understanding The Electric Vehicle Credit Strategic Finance

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption